Useful Reselling Tax Tips From a Bonafide Reseller CPA

It ain’t exactly the most interesting thing to talk about. Taxes. Like, you’d never show up to a first date with your phone Notes full of financial knowledge just to sit there and spit them out all night. They’d leave. You’d cry. It would be a mess and probably end up on the viral end of the Internet.

But it’s the end of January and the reality stands: the tax man cometh. Doesn’t matter if you’re selling half-a-million via Amazon FBA or simply dropping a few things onto eBay every so often to clear out closet space, you’re still liable to pay the IRS. And unfortunately in the age of tech dominance it’s becoming harder and harder to hide your income — small or large as it may be — from those in charge.

It can all seem daunting, for sure, especially if you’re new to this and have never taken an economics class … awake … in your life. That’s why we reached out to Mark Tew, certified CPA and bonafide reseller (he’s one of us!) to explain it slowly. His clients range between all age groups, all tax brackets and all backgrounds of tax knowledge. He also hosts an online teaching guide via YouTube that moves at your own pace and comes at a low cost basis to you initially, but may end up saving real money in the long run.

The first thing Mark says to do when reselling online is to avoid the simple missteps often made by others.

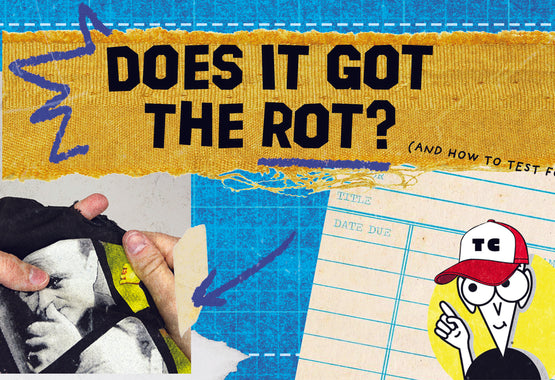

“I think the biggest mistake made is just not having any bookkeeping or record keeping system in place,” he says. “Either they don’t know they’re supposed to, or it’s overwhelming.”

This is one of the most important steps in running a small business for two reasons, he says. “One is so you as a business owner know how your business is performing, so you know what your profitability is like. So you can have the information you need to drive your business forward. Two, you need those in place so you can provide an accurate picture to the IRS for tax purposes.”

He says this step doesn’t have to be some crazy, corporate-level software recording day to day everythings. It can be a simple spreadsheet or even just a pencil and paper if you’re into hard copy. Getting this one pivotal thing in order should compliment your comfort level. Plenty of free YouTube videos are out there to help small businesses get in line with this step.

Along with the bookkeeping efforts, Mark says resellers should also have a separate bank account for all business transactions. This makes it easier to keep track of things throughout the year and may come with added perks depending on the banking system you go through. Whether this is opened as a sole proprietorship or LLC is entirely dependent on you and what you’re into. (Click here to read about what that actually means.)

Next is to actually know what you are (and what you’re not) liable for at the end of the year. Because it’s different for everybody, there’s no real general umbrella to be caught under to ensure protection without figuring out the details on your own. There is, however, a bottom line rule that small businesses owners should shoot for while figuring this out.

“A rough estimate is [to save] anywhere between 20-30% of your profit for taxes,” Mark says. It’s also up to the IRS whether it wants a large chunk at the end of the year or to break it up into smaller payments each quarter. “Typically if you’re going to owe over $1000 at the end of the year the IRS wants you to break it up.”

Of course with anything government related, it’s never easy, nor is it ever perfect. Just when you think you have it all figured out, somebody somewhere decides to throw a wrench in the whole operation. That’s the case for resellers now that the American Rescue Plan Act has been enacted.

According to that super lengthy, not at all helpful chunk of legislation, the federal threshold for companies issuing a 1099-K will drop to $600 (down from $20,000) with no minimum transaction level (down from 200). This basically means that anything you sell over $600 on any platform is liable to be taxed. Yes, really. Doesn’t mean it will be taxed, but chances are, well …

Isn’t that a kick in the pants? For years U.S. citizens scream “tax the rich!” or “appropriate funds responsibly!” and the best they can do is target hobbyists and financial nobodies. *eye roll* Anyway ...

Sarah O’Brien, writer for CNBC, puts it this way: “Generally speaking, if you’re selling to make a profit for reasons that go beyond nurturing a hobby, you probably would be considered a business owner for tax purposes. For instance, if you regularly buy clothes at yard sales (or other discounted spots) and sell them — whether online or not — with the intent of making a profit, that counts.

Basically, if you’re going to risk the chance of ducking the government or lying about income or revenue, that’s on you. Unless you’ve paid for a few senators or have a distant cousin higher up in the Wall Street food chain chances are they’ll find you eventually and that bill comes at a steep price. To boot, there aren’t many successful small businesses out there that don’t pay taxes the right way. If you’re looking for any kind of longevity in reselling it’s best to come correct.

The hard part is starting. But once you get it, you’ve got it.

THINGS YOU CAN (and should) DEDUCT, ACCORDING TO MARK TEW, CPA:

Home Office: "All you need is some space that you use at home for work. That qualifies you for that deduction"

Mileage: "A lot of people forget to track business mileage. If you’re driving to the post office or to your warehouse or go out sourcing, that’s all deductible mileage."

Cell Phone / Internet: "You can deduct the business portion of your cell phone or Internet use. Those are ones people don’t typically think about or forget about."

[cover photo Erik Mclean via Unsplash]